Oil is one of the most crucial commodities in the global economy. It drives industries, powers transportation, and is a vital component in the production of numerous goods. As such, oil price fluctuations can have a profound impact on the global economy, influencing everything from inflation rates to geopolitical stability. For investors, understanding the dynamics of oil prices and how they affect the broader economy is essential for making informed financial decisions. In this blog, we’ll explore the factors driving oil price fluctuations, their impact on the global economy, and what investors should know to navigate these changes.

The Importance of Oil in the Global Economy

Oil is often referred to as the “lifeblood” of the global economy, and for good reason. It is not only the primary source of energy but also a critical input for countless industries. From manufacturing to transportation and agriculture, oil is an indispensable resource.

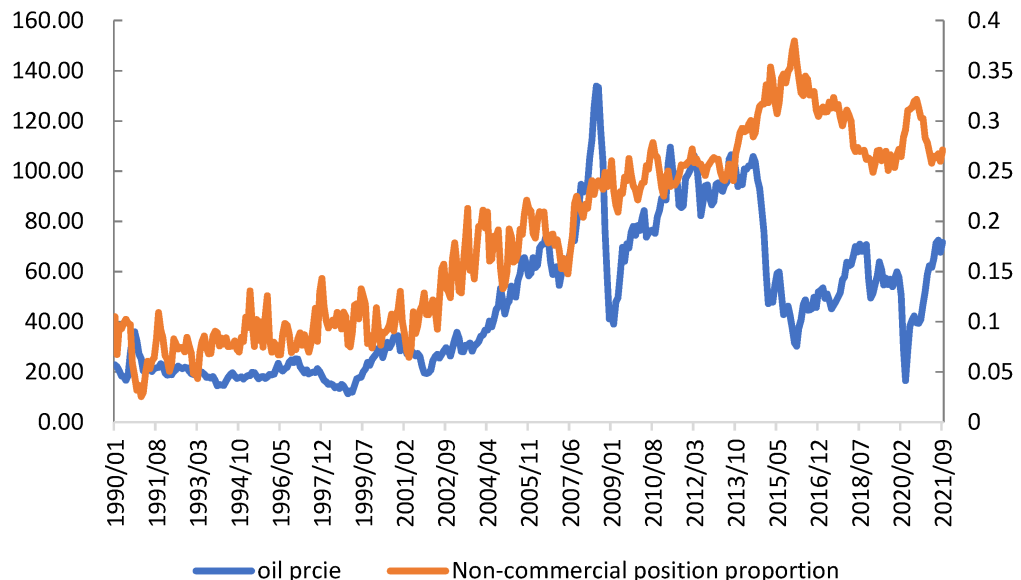

As one of the world’s most traded commodities, the price of oil is a key indicator of global economic health. When oil prices rise or fall significantly, it can signal changes in demand, shifts in production, or fluctuations in geopolitical stability, all of which influence global markets.

Factors Driving Oil Price Fluctuations

Several factors contribute to the fluctuating price of oil. These can be broadly categorized into demand-side factors, supply-side factors, and geopolitical factors.

1. Demand-Side Factors

- Global Economic Growth: One of the most significant drivers of oil price fluctuations is global economic growth. During periods of robust economic expansion, the demand for oil increases, pushing prices higher. Conversely, during economic slowdowns or recessions, demand for oil typically falls, leading to lower prices.

- Seasonal Demand: Certain times of the year see an increase in demand for oil, such as winter, when heating oil is needed, or during the summer driving season, when fuel consumption rises. These seasonal factors can cause short-term price fluctuations.

- Technological Advances and Energy Substitution: The rise of renewable energy sources, electric vehicles, and advancements in energy efficiency technologies may decrease demand for oil in the long term, putting downward pressure on prices.

2. Supply-Side Factors

- OPEC Production Decisions: The Organization of Petroleum Exporting Countries (OPEC) plays a key role in regulating oil supply. OPEC countries can agree to increase or decrease oil production in response to global demand, which in turn affects prices. Any changes in OPEC’s output can cause price volatility.

- US Shale Production: The United States has become a major oil producer due to advancements in shale extraction technology. As U.S. production increases or decreases, it can directly influence global oil prices.

- Natural Disasters and Supply Disruptions: Events such as hurricanes, earthquakes, or geopolitical conflicts can disrupt oil production and supply chains. These disruptions lead to a reduction in oil supply, causing prices to rise.

3. Geopolitical Factors

- Political Instability in Oil-Producing Countries: Geopolitical tensions in key oil-producing regions, such as the Middle East, can have a significant impact on oil prices. Political unrest, military conflicts, or sanctions targeting oil-producing nations can lead to supply shortages and price spikes.

- Trade Policies and Sanctions: Trade relations, tariffs, and sanctions imposed by major economies, such as the U.S. or China, can impact oil prices. For example, sanctions on Iran or Venezuela have disrupted their oil exports, causing a reduction in supply and a corresponding increase in global oil prices.

- Global Trade Agreements: Agreements between major oil-producing countries and global powers can influence supply levels and, by extension, oil prices. Trade wars or changes in global trade policy can also lead to fluctuations in oil prices.

How Oil Price Fluctuations Impact the Global Economy

Oil price fluctuations can have a profound impact on the global economy, influencing various sectors and leading to both positive and negative outcomes. Here’s a look at some of the key effects:

1. Inflation and Cost of Living

Oil is a key input for many industries, including transportation, manufacturing, and agriculture. When oil prices rise, production costs for goods and services increase, leading to higher prices for consumers. This phenomenon is known as cost-push inflation. For consumers, higher fuel prices can lead to increased transportation costs, while businesses face higher operational expenses.

On the flip side, falling oil prices can ease inflationary pressures, reducing production costs and potentially lowering the cost of goods and services, benefiting consumers and businesses alike.

2. Impact on Consumer Spending

When oil prices rise, consumers typically face higher fuel costs and increased prices for goods and services. This can reduce disposable income, as people spend more on essentials like fuel and utilities, leaving less money for discretionary spending. This reduction in consumer spending can negatively impact economic growth, particularly in economies heavily reliant on consumer consumption.

3. Stock Market Volatility

Oil price changes have a direct impact on stock markets. When oil prices rise, it can hurt industries that are heavily reliant on energy, such as airlines, transportation companies, and manufacturers. Conversely, lower oil prices may benefit these industries by reducing operational costs. Therefore, stock market performance often correlates with oil price movements.

However, the effect of oil price changes can also depend on the broader economic environment. For example, rising oil prices during periods of strong global growth may not have the same negative effect as rising prices during a recession.

4. Exchange Rates and Currency Value

Oil price fluctuations can affect exchange rates, particularly for oil-exporting and oil-importing countries. When oil prices rise, oil-exporting nations like Russia, Canada, and Saudi Arabia benefit from increased revenues, which can strengthen their currencies. On the other hand, oil-importing nations like Japan, India, and many European countries may experience a weakening of their currencies as they face higher import costs.

5. Impact on Global Trade and Economic Growth

Oil is crucial for transportation, and higher oil prices can increase the cost of shipping goods, leading to higher prices in global markets. This can particularly affect developing economies that rely heavily on oil imports, as rising oil prices can limit their ability to grow economically. Additionally, when oil prices rise, it can reduce global trade volumes, leading to slower economic growth worldwide.

What Investors Need to Know About Oil Price Fluctuations

For investors, understanding the impact of oil price fluctuations is key to making informed decisions. Here are some important takeaways:

- Diversification is Key: Since oil prices are highly volatile, diversifying investments across different sectors and asset classes can help mitigate risks associated with oil price changes. Holding a mix of equities, bonds, commodities, and cash can provide a more balanced portfolio.

- Monitor Geopolitical Risks: Geopolitical events can have a huge impact on oil prices, so keeping an eye on international news, trade agreements, and conflicts in key oil-producing regions is essential for understanding price movements.

- Hedge with Oil ETFs: Investors looking to gain exposure to oil prices without directly buying crude oil can consider exchange-traded funds (ETFs) that track the performance of oil futures or oil companies.

- Energy Stocks: For long-term investors, energy stocks can be an attractive option. Companies in the oil and gas sector often benefit from rising oil prices, and their stock prices may rise in tandem with oil prices. However, it’s important to evaluate the financial health of these companies and their ability to manage price volatility.

- Consider Renewable Energy: With growing concerns about climate change and the shift towards renewable energy, investing in companies focused on alternative energy sources such as solar, wind, and hydrogen can provide long-term growth potential, especially if oil prices remain high or continue to fluctuate.

Conclusion

Oil price fluctuations are a critical factor in the global economy, with far-reaching effects on inflation, consumer spending, trade, and economic growth. As an investor, it’s crucial to understand how these fluctuations impact the broader economic landscape and how to protect your investments. By staying informed about supply and demand dynamics, geopolitical factors, and energy trends, you can better position your portfolio to navigate the volatility that comes with oil price fluctuations.