India’s stock market has seen a paradigm shift in recent years, driven by increased awareness, accessibility, and financial literacy. As the economy grows and technology advances, Indian investors are actively exploring opportunities in the stock market. This blog delves into how Indian investors are embracing the stock market, the trends shaping their investment journey, and the challenges they face.

1. The Rise of Retail Investors

Retail investors have emerged as a dominant force in India’s stock market. Platforms like Zerodha, Groww, and Upstox have made stock trading easier, affordable, and more accessible.

- Key Statistics:

- The number of Demat accounts crossed 140 million in 2023, a significant jump from just 50 million in 2019.

- Retail investors accounted for over 45% of the total market turnover in 2023.

Pro Tip: If you’re new to the stock market, start small and invest in index funds to minimize risks.

2. Technology as an Enabler

The advent of technology has transformed the stock market landscape. Mobile apps, AI-driven insights, and digital platforms allow investors to trade seamlessly.

- Technological Advancements:

- AI-Powered Tools: Predictive analytics and robo-advisors offer personalized investment suggestions.

- Mobile Accessibility: Apps provide real-time updates and trading options on the go.

- Social Media: Investors use platforms like Twitter and YouTube for market insights.

Pro Tip: Leverage free learning resources and tools offered by these platforms to build your financial knowledge.

3. Increased Financial Literacy

Indian investors are becoming more financially aware, thanks to educational initiatives by financial institutions, influencers, and government campaigns.

- Sources of Financial Education:

- Online courses and webinars.

- Influencers like Pranjal Kamra and CA Rachana Ranade sharing simplified investment strategies.

- SEBI’s investor awareness programs.

Pro Tip: Before investing, understand concepts like risk tolerance, asset allocation, and diversification.

4. Shift Towards Long-Term Investments

Indian investors are moving away from speculative trading to long-term wealth creation through systematic investment plans (SIPs) and equity mutual funds.

- Investment Trends:

- Over 6,000 crores flow into equity mutual funds through SIPs every month.

- Long-term holdings have outperformed short-term trades, especially in blue-chip stocks.

Pro Tip: Adopt a disciplined investment approach by automating your SIPs.

5. Increased Participation in IPOs

The IPO market in India has witnessed a boom, with companies across sectors raising capital through public listings.

- IPO Highlights:

- Over 100 IPOs launched between 2020-2023, raising billions of dollars.

- Sectors like fintech, healthcare, and technology dominated IPO listings.

Pro Tip: Research a company’s fundamentals before investing in its IPO.

6. Challenges Faced by Indian Investors

While enthusiasm is high, Indian investors face several challenges:

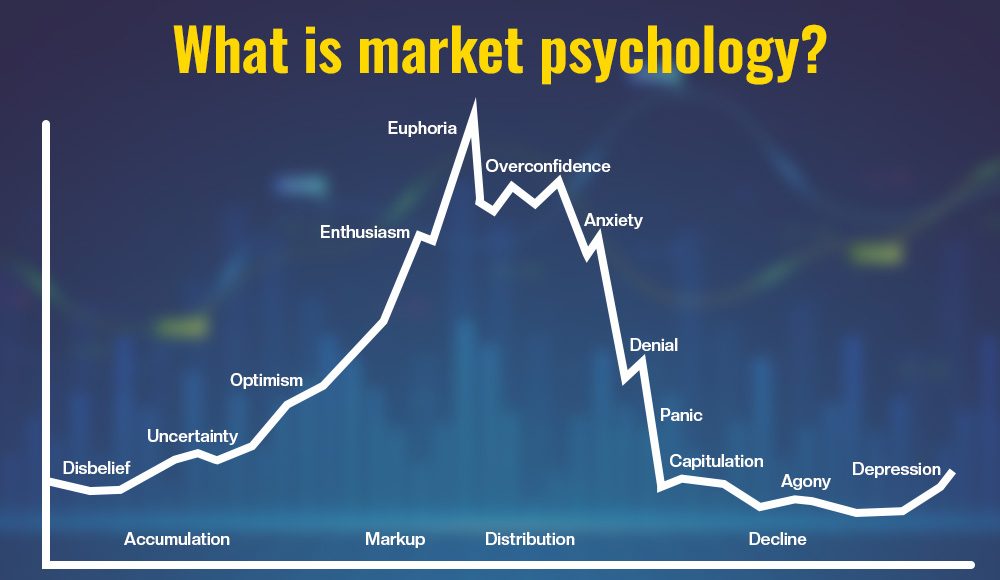

- Market Volatility: Sudden market fluctuations can lead to panic selling.

- Lack of Financial Discipline: Impulse trading often leads to losses.

- Scams and Misinformation: Frauds and misleading stock tips are prevalent.

- Regulatory Complexity: Understanding taxation and compliance can be daunting.

Pro Tip: Develop a well-thought-out strategy and consult a financial advisor to navigate these challenges.

7. Government and Regulatory Support

The Indian government and SEBI have implemented various measures to foster a robust stock market ecosystem:

- Key Initiatives:

- Investor Protection Fund: Safeguards investor interests.

- Tax Benefits: Reduced taxes on long-term capital gains.

- Startup Support: Simplified IPO regulations for startups.

Pro Tip: Stay updated with regulatory changes to make informed decisions.

Conclusion

Indian investors are redefining the dynamics of the stock market with their active participation, technological adoption, and focus on long-term wealth creation. As the ecosystem evolves, the synergy between technology, financial literacy, and regulatory support will further empower Indian investors. By embracing a disciplined approach and leveraging available resources, anyone can become a successful participant in India’s stock market.

FAQs

Q1: How can I start investing in the Indian stock market?

A: Open a Demat and trading account through a reliable brokerage platform, and begin by investing in blue-chip stocks or index funds.

Q2: What are the best platforms for stock trading in India?

A: Popular platforms include Zerodha, Groww, Upstox, and Angel One.

Q3: Are IPOs a good investment option?

A: IPOs can be lucrative but require thorough research on the company’s financials and growth potential.

Q4: What is the role of SEBI in India’s stock market?

A: SEBI regulates the stock market, protects investor interests, and ensures market transparency.

Q5: How can I minimize risks in stock market investing?

A: Diversify your portfolio, invest for the long term, and avoid impulsive trading decisions.